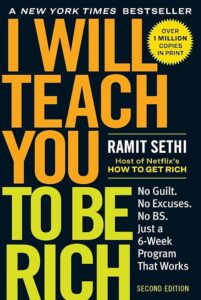

I Will Teach You to Be Rich: No Guilt. No Excuses. Just a 6-Week Program That Works (Second Edition)

Would You Rather Be Sexy or Rich?

by DenzelleThe introduction of “Would You Rather Be Sexy or Rich?” cleverly draws a parallel between managing personal finances and maintaining physical health. The author uses the metaphor of weight management to frame the idea that both areas often receive attention only when problems become urgent. Just as unnoticed weight gain can escalate into a health crisis, neglecting financial habits can lead to long-term instability, emphasizing the importance of proactive, sustainable strategies over quick fixes.

The comparison extends to how both industries—diet and finance—tend to promote short-term solutions over fundamental, lasting changes. In weight management, fad diets promise immediate results but rarely lead to lasting health improvements, much like how financial “hacks” can offer temporary relief without addressing deeper habits. The author emphasizes simplicity as the key: for weight, it’s eating less and exercising more; for finances, it’s spending less than you earn and investing wisely. This focus on the basics sets the stage for a more grounded and achievable approach to personal improvement.

A central theme of the introduction is addressing the common excuses that prevent people from making better financial decisions. Many feel overwhelmed by the sheer amount of information available or attribute their struggles to external circumstances. The author counters this mindset by advocating for small, manageable steps rather than striving for perfection, making the path to financial health accessible to everyone. Taking responsibility is presented not as a burden but as an empowering choice to take control of one’s future.

The introduction also challenges societal pressures to focus on appearing wealthy rather than being financially secure. The author highlights the stark difference between projecting an image of success and actually building long-term wealth. While the allure of flashy purchases and social validation may be tempting, the tangible benefits of financial independence—freedom, security, and the ability to make choices based on personal values—far outweigh the fleeting appeal of outward appearances.

A significant idea introduced is the concept of living a “Rich Life,” which is deeply personal and varies based on individual values and goals. The author urges readers to define wealth on their own terms, whether it’s traveling the world, supporting family, or pursuing a passion project. Financial independence becomes the means to achieving these aspirations, providing the freedom to live authentically and without constraints imposed by financial stress.

The introduction sets the tone for the book’s practical, action-oriented approach by outlining a six-week plan for building financial stability. This plan covers foundational topics such as managing credit cards, optimizing bank accounts, starting investments, and automating finances to minimize decision fatigue. The focus is on simplicity and long-term growth, making the process approachable for readers at any stage of their financial journey.

The author concludes the introduction with a motivational call to action, emphasizing the importance of starting now rather than waiting for the perfect moment. By prioritizing action over perfection, readers are encouraged to embrace the idea that small, consistent steps can lead to transformative results. This proactive mindset lays the groundwork for readers to take ownership of their financial futures, making decisions that align with their goals and values.

In essence, the introduction of “Would You Rather Be Sexy or Rich?” uses the relatable metaphor of weight management to make the complexities of financial planning more accessible. By breaking down the barriers of overwhelm and societal pressure, the author inspires readers to take a balanced, informed approach to achieving both financial health and personal fulfillment. Through a mix of expert advice, personal anecdotes, and practical steps, the book sets the stage for readers to redefine their relationship with money and take the first steps toward a more secure and meaningful life.

0 Comments