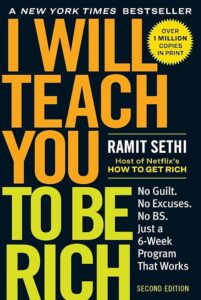

I Will Teach You to Be Rich: No Guilt. No Excuses. Just a 6-Week Program That Works (Second Edition)

Chapter 9: A Rich Life

by DenzelleIn Chapter 9 of I Will Teach You to Be Rich, Ramit Sethi explores the idea of a “Rich Life,” emphasizing how financial decisions intertwine with major life events such as marriage, raising children, and purchasing a home. He opens the chapter by sharing a candid conversation with his then-girlfriend, Cass, about their financial priorities. This includes discussing potentially sensitive topics like prenuptial agreements. By highlighting this dialogue, Sethi demonstrates the importance of proactive communication and planning in establishing a stable financial future. The narrative sets the stage for his broader message: building a Rich Life is less about amassing wealth and more about creating freedom and security.

Sethi makes it clear that living richly does not equate to spending extravagantly or pursuing endless financial growth. Instead, it is about making intentional choices that reduce financial stress and enable meaningful experiences. He illustrates this with a personal anecdote about his luxurious safari honeymoon in Kenya. The trip, a dream realized through careful planning and disciplined saving, serves as an example of how deliberate financial decisions can result in extraordinary experiences without undue anxiety. This approach reinforces his belief in prioritizing joy and fulfillment over mindless consumption.

The chapter delves into the common financial dilemmas people face, such as whether to pay off student loans quickly or focus on investing. Sethi advises a balanced approach tailored to individual circumstances, urging readers to take advantage of tax-advantaged accounts like 401(k)s and IRAs. By explaining the power of compound interest, he underscores the benefits of starting to invest as early as possible. This strategy not only sets the stage for long-term financial stability but also provides a sense of security during life’s inevitable ups and downs.

Clear communication about finances emerges as a central theme, particularly within relationships. Sethi uses his own marriage as an example, offering advice on how to approach shared goals and navigate disagreements about money. He stresses the importance of transparency, whether discussing day-to-day expenses or larger commitments like prenuptial agreements. These conversations, he argues, build trust, mutual respect, and a sense of partnership, all of which are essential for both financial success and a healthy relationship.

Sethi also cautions against the temptation of quick-fix financial schemes, advocating instead for steady, informed investment strategies. He provides readers with actionable steps for addressing debt, such as developing a clear repayment plan while continuing to save and invest. This balanced approach helps individuals avoid sacrificing long-term growth for short-term relief. By maintaining focus on sustainable strategies, Sethi equips readers to achieve their financial goals while sidestepping unnecessary risks.

Another vital aspect of a Rich Life, according to Sethi, is generosity. He encourages readers to give back in ways that align with their values, whether through donations, volunteering, or supporting loved ones. This practice of philanthropy, he explains, adds a deeper layer of purpose to financial success. For Sethi, true richness extends beyond personal gain; it involves enriching the lives of others while staying true to one’s financial priorities.

Throughout the chapter, Sethi uses relatable anecdotes and a conversational tone to make complex financial concepts accessible and engaging. He redefines wealth, presenting it as a tool for crafting a fulfilling life rather than as an end in itself. His emphasis on integrating financial stability with personal fulfillment offers a refreshing perspective. By focusing on experiences, relationships, and values, he encourages readers to move beyond traditional notions of success and toward a more holistic understanding of richness.

The chapter ultimately serves as both a guide and an inspiration for navigating major life decisions. Sethi’s advice on investing early, managing debt strategically, and fostering open communication provides practical steps that readers can implement immediately. Additionally, his focus on philanthropy challenges conventional ideas of wealth by promoting generosity and mindfulness. Sethi’s vision of a Rich Life is not about endless accumulation but about finding balance and purpose, ensuring that both financial health and personal happiness are prioritized. This comprehensive approach empowers readers to redefine their goals and build lives filled with intentionality, joy, and meaningful connections.

0 Comments