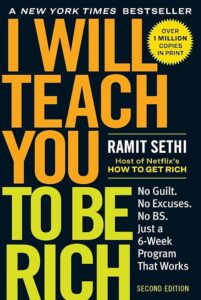

I Will Teach You to Be Rich: No Guilt. No Excuses. Just a 6-Week Program That Works (Second Edition)

Chapter 1: Optimize Your Credit Cards

by DenzelleThe opening chapter of “Optimize Your Credit Cards” shifts the narrative on credit cards from cautionary tales to empowerment, offering actionable insights into leveraging credit cards effectively. The author starts with a relatable and humorous anecdote about how cultural influences shaped their negotiating skills, particularly when making significant financial decisions like buying a car. This sets the stage for a broader discussion on why consumers should adopt a proactive, strategic approach to credit cards instead of succumbing to fear-based advice.

Traditionally, credit cards have been cast in a negative light, often associated with debt traps and financial mismanagement. However, the author reframes them as powerful tools that, when used responsibly, can offer significant benefits. These include perks like extended warranties, travel rewards, rental car insurance, and cashback offers, all of which can save money or add value to everyday transactions. By emphasizing these advantages, the chapter demonstrates how credit cards can be a financial ally rather than an adversary.

One of the chapter’s key themes is the importance of maintaining a healthy credit score, as it plays a critical role in determining the cost of loans and large purchases. The author explains how responsible credit card use—such as paying balances on time and keeping credit utilization low—can positively impact creditworthiness. Readers are also given actionable advice, like setting up payment reminders, disputing errors on their credit reports, and negotiating with credit card issuers to secure better terms, such as lower APRs.

Acknowledging the reality of credit card debt, the author doesn’t shy away from addressing its challenges. They provide readers with effective strategies to pay down debt, such as focusing on high-interest balances first or consolidating debt into lower-interest options. Additionally, they emphasize the impact of even small extra payments toward the principal balance, showing how these contributions can reduce interest costs over time. Personal success stories are interwoven throughout the chapter, demonstrating the effectiveness of persistence and negotiation in overcoming debt.

A standout feature of the chapter is its emphasis on negotiation as a vital financial skill. The author shares tips on how to approach credit card companies for better terms, including lowering APRs, waiving annual fees, or securing higher credit limits. These proactive strategies not only save money but also empower readers to take control of their financial relationships rather than passively accepting unfavorable conditions.

The chapter advocates for an offensive approach to financial management, encouraging readers to optimize credit card usage instead of avoiding it altogether. By leveraging rewards programs, managing payments wisely, and maintaining a strong credit score, individuals can make their credit cards work for them rather than against them. This proactive mindset is a cornerstone of the book’s philosophy, positioning credit cards as tools to build wealth and improve financial stability.

In addition to everyday perks, the author explains how credit cards can be instrumental in achieving long-term financial goals. Rewards points can offset travel costs, cashback programs can supplement savings, and features like purchase protection can reduce unforeseen expenses. The chapter encourages readers to align their credit card strategies with their broader financial goals, ensuring that every swipe contributes to their overall financial well-being.

While the chapter highlights the benefits of credit cards, it also acknowledges their potential pitfalls if mismanaged. Readers are reminded of the importance of budgeting, avoiding unnecessary purchases, and never carrying a balance beyond what they can afford to pay off monthly. This balanced perspective ensures that readers understand the responsibility that comes with credit card ownership, empowering them to avoid the common mistakes that lead to financial stress.

Throughout the chapter, the author includes relatable anecdotes and testimonials from individuals who have successfully optimized their credit card use. These stories illustrate how small changes, like negotiating lower interest rates or taking advantage of rewards programs, can lead to significant financial gains. By sharing these examples, the chapter inspires readers to take control of their credit cards and make informed decisions that align with their goals.

Chapter 1 challenges the traditional view of credit cards as financial burdens, reframing them as tools that, when used strategically, can unlock significant advantages. By offering practical advice on building credit, managing debt, and maximizing rewards, the chapter equips readers with the knowledge to make smarter financial decisions. The overarching message is clear: with responsibility, persistence, and a proactive mindset, credit cards can become a cornerstone of financial empowerment and success.

0 Comments