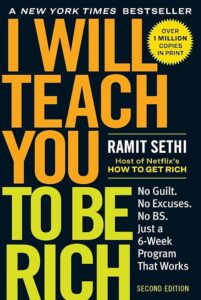

I Will Teach You to Be Rich: No Guilt. No Excuses. Just a 6-Week Program That Works (Second Edition)

Chapter 2: Beat the Banks

by DenzelleIn Chapter 2 of “Beat the Banks,” the focus shifts to refining your banking strategy, emphasizing that choosing the right bank is a cornerstone of building a strong financial foundation. The chapter begins by exposing the pitfalls of traditional neighborhood banks, which often burden customers with high fees, low-interest rates, and excessive requirements like minimum balances. Many consumers unknowingly fall into these traps due to inertia and a lack of awareness about better alternatives, making them easy targets for such predatory practices.

Traditional banks rely heavily on fees, including overdraft charges, monthly maintenance fees, and penalties for not maintaining minimum balances. These seemingly small charges can accumulate over time, significantly draining a person’s savings. The author illustrates this through personal anecdotes and real-life examples, such as Jamie B., who faced financial hardships due to recurring overdraft fees and a poorly managed account. Such stories reveal how the lack of transparency in fee structures can derail financial stability.

A particularly intriguing point in this chapter is the contrast between customer service standards in banking and other industries. While most businesses, like Amazon, thrive on excellent customer service, banks often continue to profit despite offering subpar experiences. The author points to unethical practices, such as Wells Fargo’s unauthorized account scandals and imposed insurance policies, to highlight how some banks exploit their customers’ trust rather than earning it. This contradiction serves as a wake-up call for readers to reevaluate their banking relationships.

The chapter shifts focus to empowering readers to make smarter, proactive decisions about where they bank. It encourages critical evaluation of a financial institution’s offerings, including fee structures, interest rates, and customer service quality. Readers are urged to research their bank’s history, ethical practices, and alignment with personal financial goals. By taking these steps, individuals can avoid unnecessary fees while gaining access to higher interest rates and better financial tools.

Rather than simply critiquing traditional banks, the chapter provides actionable steps for setting up an efficient and cost-effective banking system. The author introduces specific criteria for evaluating banks, such as comparing annual percentage yields (APYs), assessing account fees, and reviewing mobile banking features. For example, switching to online banks or credit unions often results in higher interest rates on savings accounts and significantly lower fees.

The author also shares their personal banking setup as a guide, recommending a mix of accounts to separate savings, checking, and emergency funds. This structure not only simplifies money management but also maximizes efficiency by leveraging the best features of different institutions. Testimonials from individuals who have successfully transitioned to high-interest, low-fee accounts further demonstrate the tangible benefits of informed decision-making.

The advantages of choosing the right banking partner go beyond avoiding fees; it can also significantly enhance your financial growth. High-interest savings accounts, offered by many online banks, allow consumers to earn more on their deposits without additional effort. Additionally, switching to a low-fee account can free up funds that can be directed toward investments or other financial goals. These benefits underscore the importance of reviewing and updating your banking setup periodically.

The chapter also introduces the idea of ethical banking, encouraging readers to consider the values and practices of their chosen institutions. Some banks actively support community programs, sustainable initiatives, or fair lending practices, aligning with customers who prioritize ethical financial behavior. By banking with institutions that reflect their personal values, individuals can feel more confident about their financial decisions while contributing positively to society.

One of the strongest messages in this chapter is the need to move past complacency. Many consumers stick with their banks out of convenience, even when the services are subpar or costly. The author argues that this passive approach to banking is a significant barrier to financial success. Taking the time to research and switch to better financial institutions is framed as an investment in one’s long-term wealth and peace of mind.

Throughout the chapter, the author includes stories from readers who made the leap to more customer-friendly banks. These testimonials illustrate how even small changes, like switching to an online bank or negotiating account fees, can lead to substantial financial improvements. These examples aim to inspire readers to take action and demonstrate the immediate and long-term rewards of better banking decisions.

Chapter 2 closes with a clear takeaway: optimizing your banking setup is a fundamental step toward achieving financial independence. By prioritizing low-cost, high-value accounts and aligning with institutions that meet personal and ethical standards, readers can take control of their financial infrastructure. The chapter positions informed decision-making as a powerful tool for minimizing losses and maximizing growth, encouraging readers to be proactive in building a banking system that supports their journey to wealth and stability.

0 Comments