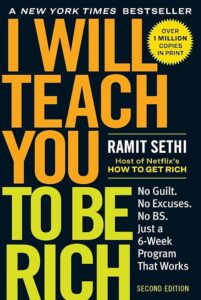

I Will Teach You to Be Rich: No Guilt. No Excuses. Just a 6-Week Program That Works (Second Edition)

Index

by DenzelleDedicated to his family, friends, mentors, agent, and wife for their unwavering support and inspiration, the author expresses heartfelt gratitude for their role in his life and the completion of this book. He warmly welcomes new readers, expressing hope that the book will guide them in creating their Rich Life. The comprehensive index covers a wide range of financial topics, including banking, investing, saving, debt management, and more, underscoring the diverse financial knowledge the book seeks to impart.

This financial guide addresses critical aspects of building and enhancing financial health. It starts with the basics of banking, such as account management and optimization, and progresses to the complexities of investing, including asset allocation, strategies, and the psychological factors that influence financial decisions. The book underscores the value of conscious spending and demonstrates how automated systems can simplify the journey toward achieving financial goals while avoiding common pitfalls in banking and investing.

It also examines the dynamics of credit, offering guidance on optimizing credit card use, managing credit scores, and handling debt strategically. Beyond technical advice, the book explores the emotional and psychological aspects of money management, debunking myths about the need for expertise in finance and encouraging a proactive mindset. It highlights the impact of life choices on financial well-being, addressing significant expenses and life events, and equips readers with the tools to make informed decisions tailored to their unique goals and circumstances.

By integrating technical financial insights with practical life guidance, the book goes beyond educating on money management mechanics. It presents a vision of financial stability as a foundation for achieving a fulfilling and rich life—one where financial well-being and personal happiness coexist harmoniously.

0 Comments