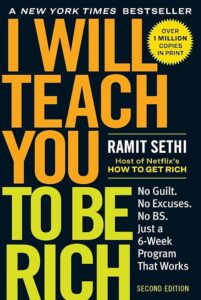

I Will Teach You to Be Rich: No Guilt. No Excuses. Just a 6-Week Program That Works (Second Edition)

In Chapter 6: The Myth of Financial Expertise

by DenzelleChapter 6 of I Will Teach You to Be Rich (Second Edition), titled “The Myth of Financial Expertise,” challenges the widely accepted authority of financial advisors and experts. It pushes readers to question their dependency on these professionals, using a compelling analogy from an experiment with wine tasters to illustrate the fallibility of expertise. By highlighting how even seasoned professionals can be swayed by biases, the chapter lays the groundwork for a broader critique of the financial advice industry.

The chapter opens with a reference to Frederic Brochet’s 2001 wine-tasting experiment, where experts were fooled into misidentifying the same wine when it was labeled as red versus white. This study demonstrates how easily biases can cloud judgment, even among experts, and serves as a metaphor for the unreliability of financial advisors. The author argues that if professionals in one domain can falter so easily, it’s worth scrutinizing the accuracy and effectiveness of financial advisors’ recommendations, particularly when they fail to deliver superior results consistently.

Cultural and educational norms often condition people to place blind trust in financial advisors, assuming their expertise guarantees better outcomes. However, this reliance can lead to suboptimal decisions, as many advisors and fund managers fail to outperform basic, low-cost investment tools such as index funds. The chapter encourages readers to reevaluate the value they receive from professional financial guidance, challenging the notion that higher fees equate to better performance. Instead, it suggests that much of the advice provided by experts may simply reinforce a system that prioritizes profits for financial institutions over clients.

Managed funds, often touted as sophisticated solutions for wealth growth, are critiqued for their hidden costs and long-term drawbacks. High management fees can significantly erode returns, leaving investors with far less than they anticipate. The chapter advocates for simpler, more efficient alternatives like index funds, which consistently outperform managed portfolios in numerous cases. This shift in focus offers readers a clearer, more transparent pathway to achieving their financial goals without unnecessary complexity or costs.

The chapter also cautions against idolizing legendary investors like Warren Buffett, emphasizing that their strategies are not universally replicable. While their success stories are inspiring, the average investor is unlikely to achieve similar results, especially when relying heavily on financial advisors. The narrative shifts toward empowering readers to focus on the basics of investing—diversification, understanding asset classes, and prioritizing low-cost strategies—over attempting to emulate extraordinary outliers.

A central theme of the chapter is financial self-reliance, achieved through education and informed decision-making. Readers are encouraged to develop their knowledge of investing, enabling them to manage their wealth confidently and independently. Simple steps, such as learning how to diversify investments and automate contributions to low-cost funds, are presented as accessible ways to build financial stability while avoiding high advisor fees. This approach not only saves money but also fosters a sense of control over personal financial growth.

Addressing the fears and insecurities that often deter individuals from self-directed investing is another key focus. The author reassures readers that with the right tools and a disciplined mindset, they can achieve their financial goals without relying on experts. Practical advice, such as automating investments and resisting emotional reactions to market fluctuations, empowers readers to stay consistent and focused on long-term success. This guidance helps demystify the process of investing, making it more approachable for those who may feel intimidated by its complexities.

The chapter concludes by urging readers to reclaim control of their financial future. It critiques the perpetuation of the myth of financial expertise, which often traps individuals in cycles of dependency that benefit advisors more than clients. By embracing low-cost, self-directed investment strategies and cultivating financial literacy, readers can break free from this dependency and build a more secure and independent financial foundation.

Ultimately, this chapter serves as both a critique and a call to action. It inspires readers to replace blind trust in financial advisors with informed, proactive decision-making. By doing so, they can unlock the tools for success that are already within their reach, paving the way for true financial empowerment and freedom.

0 Comments